It was founded in 1864 as the Merchants Bank of Halifax and later renamed the Royal Bank of Canada (RBC), following the merger of several regional banks. RBC’s early growth was characterized by expansion across Canada. It pioneered Canadian banking innovation in the 1960s by introducing the country’s first automated teller machines. RBC gradually expanded internationally, establishing a global presence. Today, it is one of Canada’s largest banks, providing a diverse range of financial services while remaining committed to innovation and community engagement.

Founding and beginnings: Royal Bank of Canada

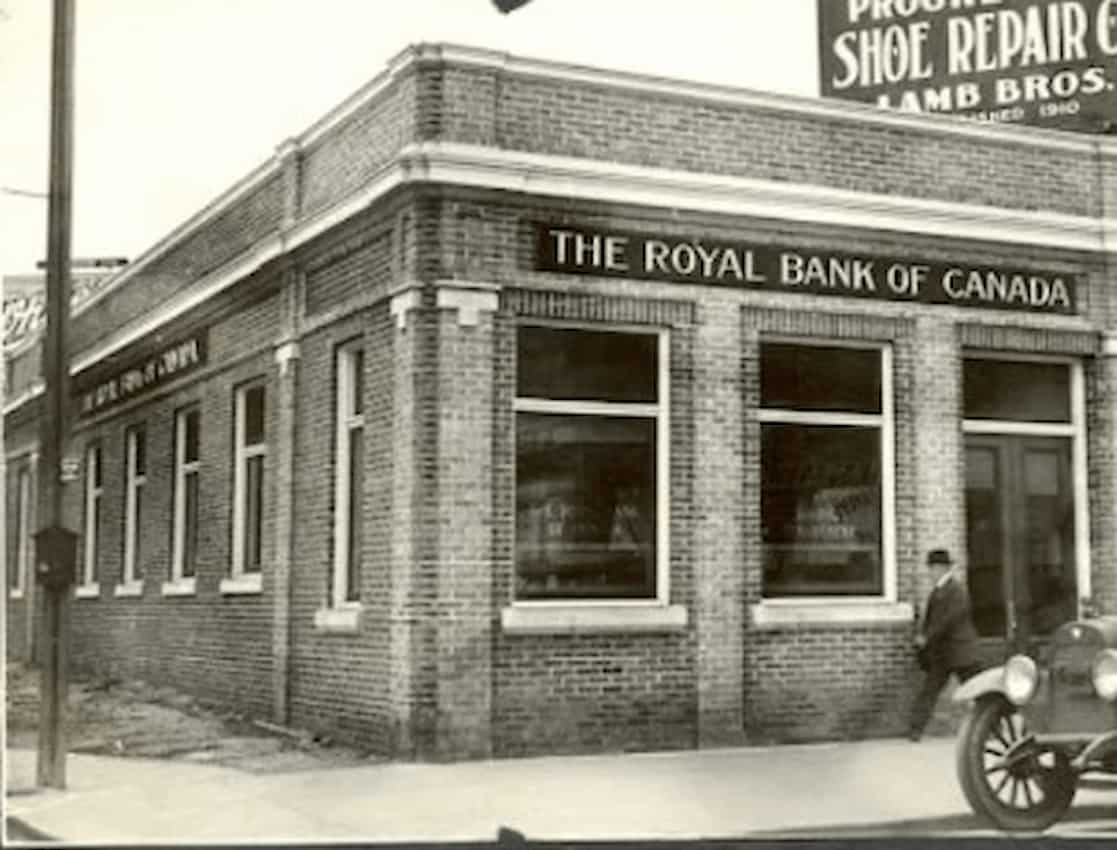

RBC’s origins can be traced back to the mid-nineteenth century, when Canada experienced rapid growth and industrialization. In 1864, a group of merchants and entrepreneurs from Halifax, Nova Scotia, formed the Merchants Bank of Halifax. This institution was later renamed the Royal Bank of Canada.

The bank’s early years were characterized by expansion and consolidation. In 1901, the Merchants Bank merged with the Union Bank of Halifax, establishing its position in the Canadian banking industry. The newly formed entity was renamed the Royal Bank of Canada to reflect its ambition and status.

Development and Growth: Royal Bank of Canada

As Canada’s economy grew, RBC capitalized on domestic and international opportunities for expansion. Throughout the early twentieth century, the bank expanded its branch network across Canada, serving businesses and individuals in both urban and rural areas.

During the 1960s and 1970s, RBC aggressively expanded by acquiring several regional banks and financial institutions. This expansion strategy allowed RBC to strengthen its market presence and broaden its service offerings, establishing it as a dominant player in the Canadian banking sector.

Innovation and Transformation: Royal Bank of Canada

RBC has always been a leader in banking innovation. In the 1960s, it introduced Canada’s first automated teller machines (ATMs), revolutionizing how customers access their funds. Throughout the following decades, RBC continued to innovate, embracing new technologies and digital channels to improve the customer experience and operational efficiency.

RBC faced new opportunities and challenges as the internet and digital banking became more prevalent. In the late twentieth and early twenty-first centuries, the bank made significant investments in digital infrastructure and online banking platforms, anticipating the shift to digital transactions and mobile banking.

Global reach and influence: Royal Bank of Canada

The Royal Bank of Canada (RBC) has strategically positioned itself as a major player in the global financial arena, wielding significant influence on multiple continents. With offices in major financial centers such as New York, London, and Hong Kong, RBC has established itself as a global banking powerhouse.

RBC’s global influence is demonstrated by its extensive network of branches, subsidiaries, and strategic partnerships, which allow the bank to meet the diverse needs of its clients worldwide. RBC’s global reach is unparalleled, whether it is providing financing solutions for multinational corporations, wealth management services to high-net-worth individuals, or enabling cross-border transactions for international businesses.

Furthermore, RBC’s influence goes beyond traditional banking services. The bank’s capital markets division is critical to global investment and advisory activities, assisting clients with complex financial transactions and capitalizing on emerging market trends. RBC has earned the trust and respect of clients, regulators, and stakeholders all over the world thanks to its innovative banking approach and commitment to excellence.

Commitment to Sustainability and the Community: Royal Bank of Canada

Since its inception, the Royal Bank of Canada’s (RBC) values have prioritized community and sustainability. RBC recognizes its corporate citizenship responsibilities and actively participates in initiatives that benefit communities and the environment.

RBC’s dedication to the community is evident in its extensive philanthropic efforts and community development programs. The bank supports a variety of charitable organizations and initiatives in education, healthcare, and social welfare. RBC strives to make a significant impact in the communities in which it operates through partnerships with community organizations and employee volunteer programs.

In addition to community engagement initiatives, RBC promotes environmental sustainability and responsible business practices. The bank has taken a variety of steps to reduce its environmental impact, including energy efficiency programs, waste reduction initiatives, and sustainable procurement practices. RBC also provides sustainable finance solutions to assist clients in addressing environmental and social challenges, such as green bonds and sustainable investment opportunities.

By incorporating sustainability into its business strategy and operations, RBC hopes to create long-term value for its stakeholders while also contributing to a more sustainable future for future generations. RBC’s commitment to community and sustainability demonstrates its desire to have a positive impact on society and the environment.

Looking Forward: RBC in the 21st Century: Royal Bank of Canada

As RBC begins its next chapter, it will face a rapidly changing landscape marked by technological disruption, regulatory changes, and shifting consumer preferences. RBC, on the other hand, is well-positioned to deal with these challenges, drawing on its legacy of innovation, financial strength, and commitment to excellence.

In the coming years, RBC will continue to evolve and adapt to meet the needs of its customers and stakeholders while remaining true to its core values of integrity, professionalism, and service excellence. With a proud history and a promising future, the Royal Bank of Canada is poised to remain a pillar of Canada’s financial system for generations to come.

The Royal Bank of Canada (RBC) has adapted to a rapidly changing financial landscape in the 21st century. RBC has made significant investments in technology to improve the customer experience and streamline operations, with digital transformation serving as a cornerstone of its strategy. The proliferation of digital banking channels, mobile apps, and online platforms has allowed RBC to provide seamless, personalized banking services to clients across Canada and beyond.

Furthermore, RBC has shifted its focus away from traditional banking services in order to meet consumers’ changing digital needs. To stay ahead of the curve, the bank has invested in fintech partnerships, explored blockchain technology, and created innovative products and services.

In addition to technological advancements, RBC continues to prioritize corporate social responsibility (CSR) and sustainability initiatives in the twenty-first century. The bank has made significant commitments to environmental sustainability, diversity and inclusion, and community development, thereby coordinating its business practices with larger societal objectives.

Looking ahead, RBC is committed to driving innovation, promoting long-term growth, and creating value for its customers, shareholders, and communities. As the banking industry evolves in response to technological advancements and changing consumer preferences, RBC is well positioned to lead the way with its unwavering commitment to excellence and forward-thinking approach.

In conclusion, the Royal Bank of Canada (RBC) shows resilience, innovation, and dedication. From its humble beginnings in the nineteenth century to its current status as a global banking powerhouse in the twenty-first century, RBC has evolved to meet the changing needs of its customers and society. With a steadfast commitment to excellence, sustainability, and community engagement, RBC is well-positioned to navigate the complexities of today’s financial landscape and remain a trusted leader in the banking industry for many years.